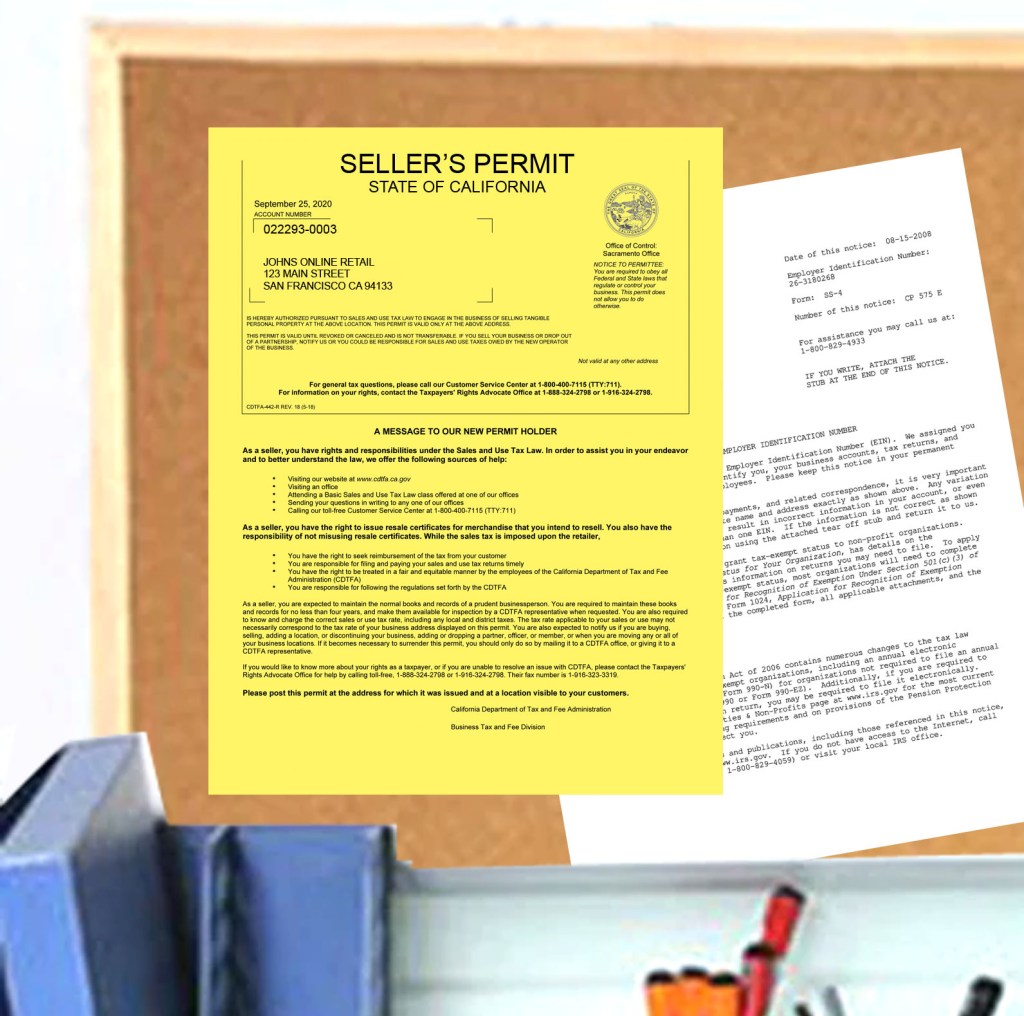

Solution to VAT Requirements for Non-UK Resident Companies - Seller

Introduction: In recent times, non-UK resident companies selling on have encountered a new challenge in the form of VAT requirements. is now asking these businesses to pay 20% VAT, regardless of whether they have crossed the sales threshold of £85,000.

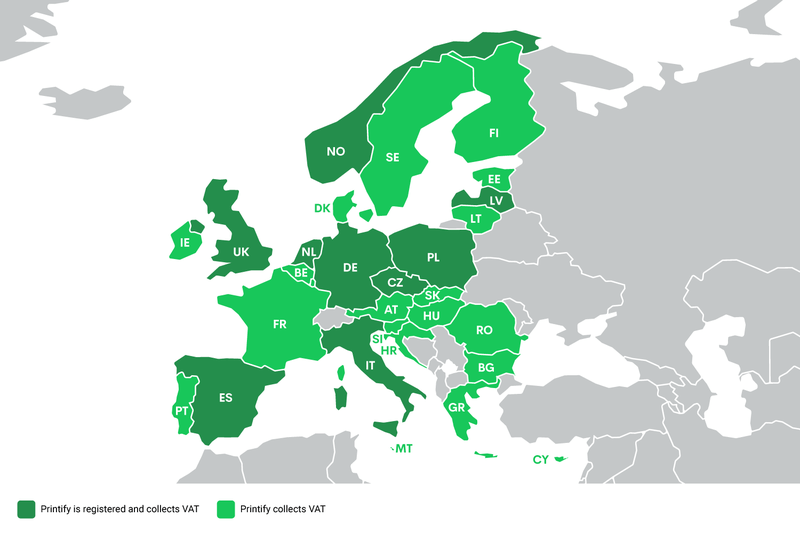

Winning European Union VAT laws with Printify

VAT between the UK and Belgium - VAT UK and Belgium

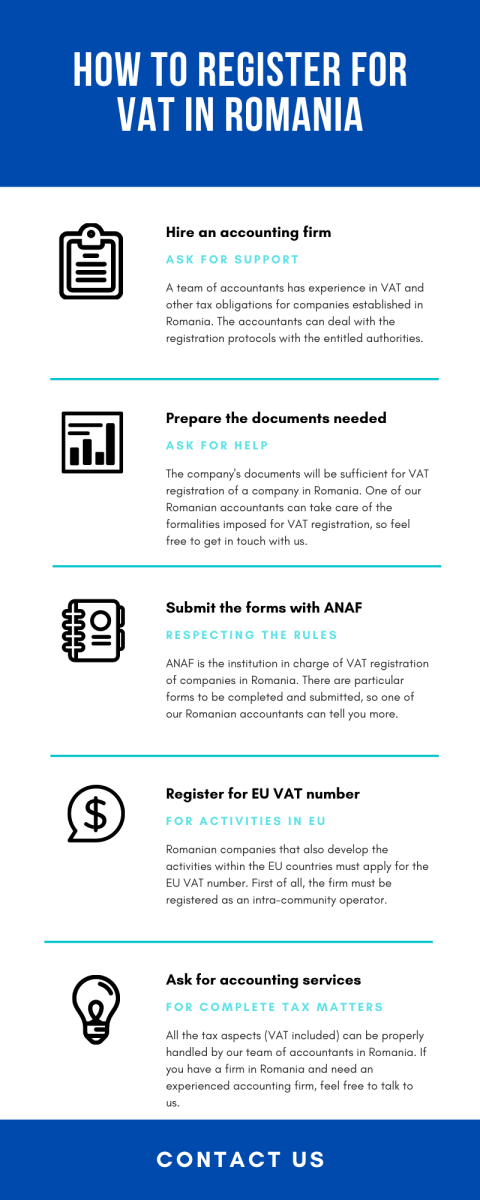

VAT Registration in Romania - Guide for 2022

If you are VAT registered and not yet in Making Tax Digital you need to act now

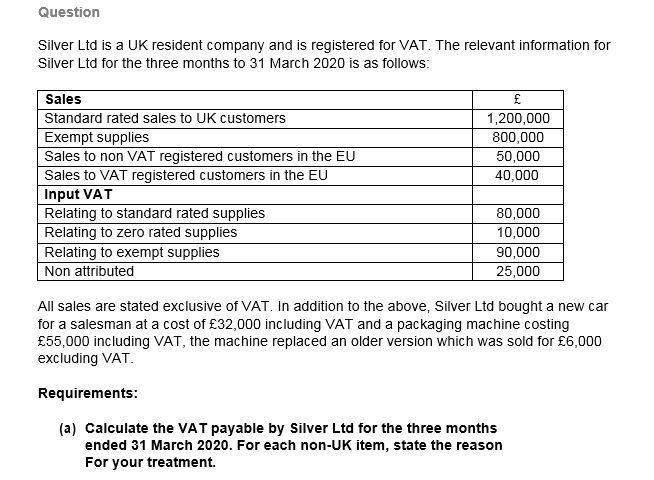

Solved Question Silver Ltd is a UK resident company and is

The Ultimate VAT Guide for Sellers in UK & Europe

Should I register for VAT?

Your disbursements have been suspended due to indicators of unmet UK business establishment requirements

Tax Help - AWS Marketplace Sellers

VAT: Agent vs Principal

Business Bank Accounts for Non-UK Residents