Climate Bonds & Banco Central do Brasil sign agreement to develop sustainable finance agenda: New partnership to share technical knowledge on climate & financial sector

The partnership aims to share technical knowledge about financial instruments and sustainable capital markets The Central Bank of Brazil (Banco Central do Brasil) and Climate Bonds Initiative have signed a new Memorandum of Understanding (MoU) with the objective of promoting a sustainable finance agenda and integration of socio-environmental and climatic risks in the national financial sector.

Sustainability

The 5th Report Towards the Localization of the SDGs by UCLG CGLU

Policy Options to Address Climate Vulnerabilities and Green the

Climate Bonds & Banco Central do Brasil sign agreement to develop

ESG Environmental - ESG News

Sustainable Finance - Financing Transition Pathways Towards a 2050

PDF) The Costs and Trade-Offs of Green Central Banking: A

Climate Bonds Initiative Mobilizing debt capital markets for

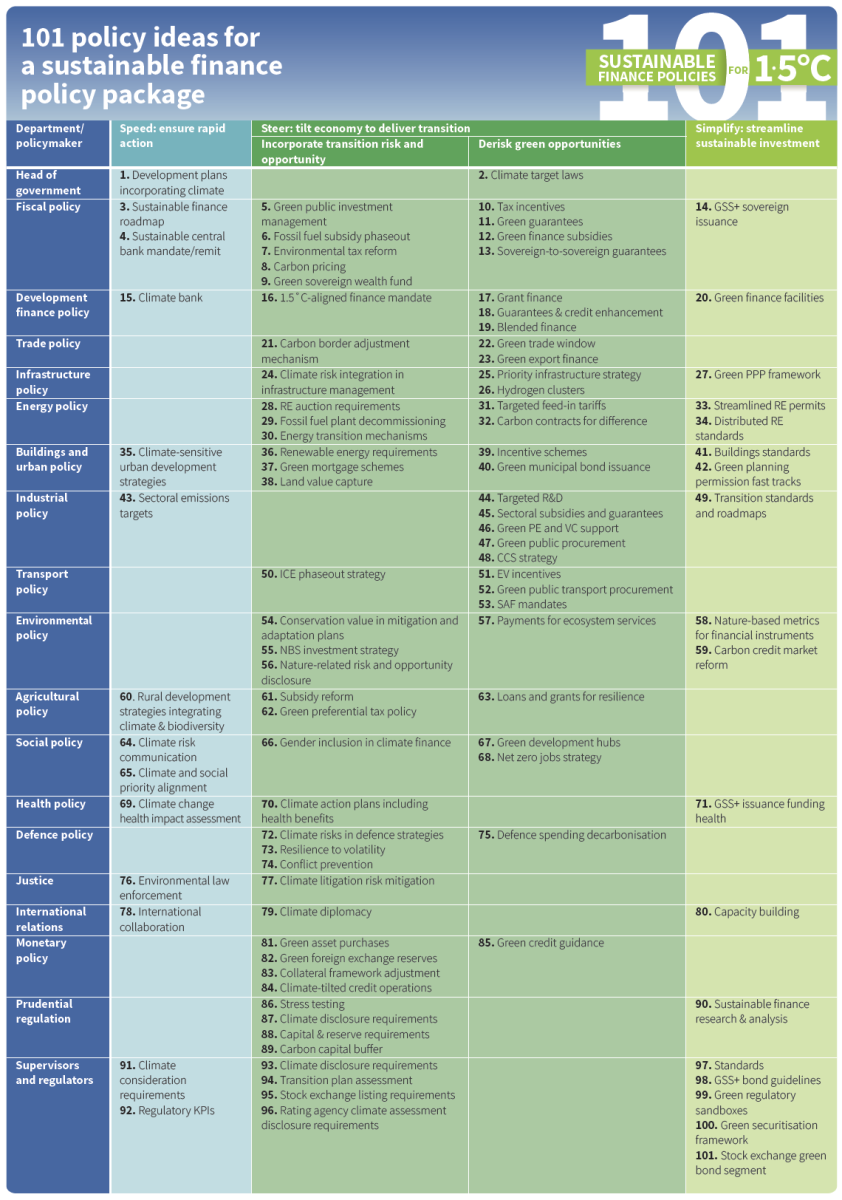

101 Sustainable Finance Policies for 1.5°C

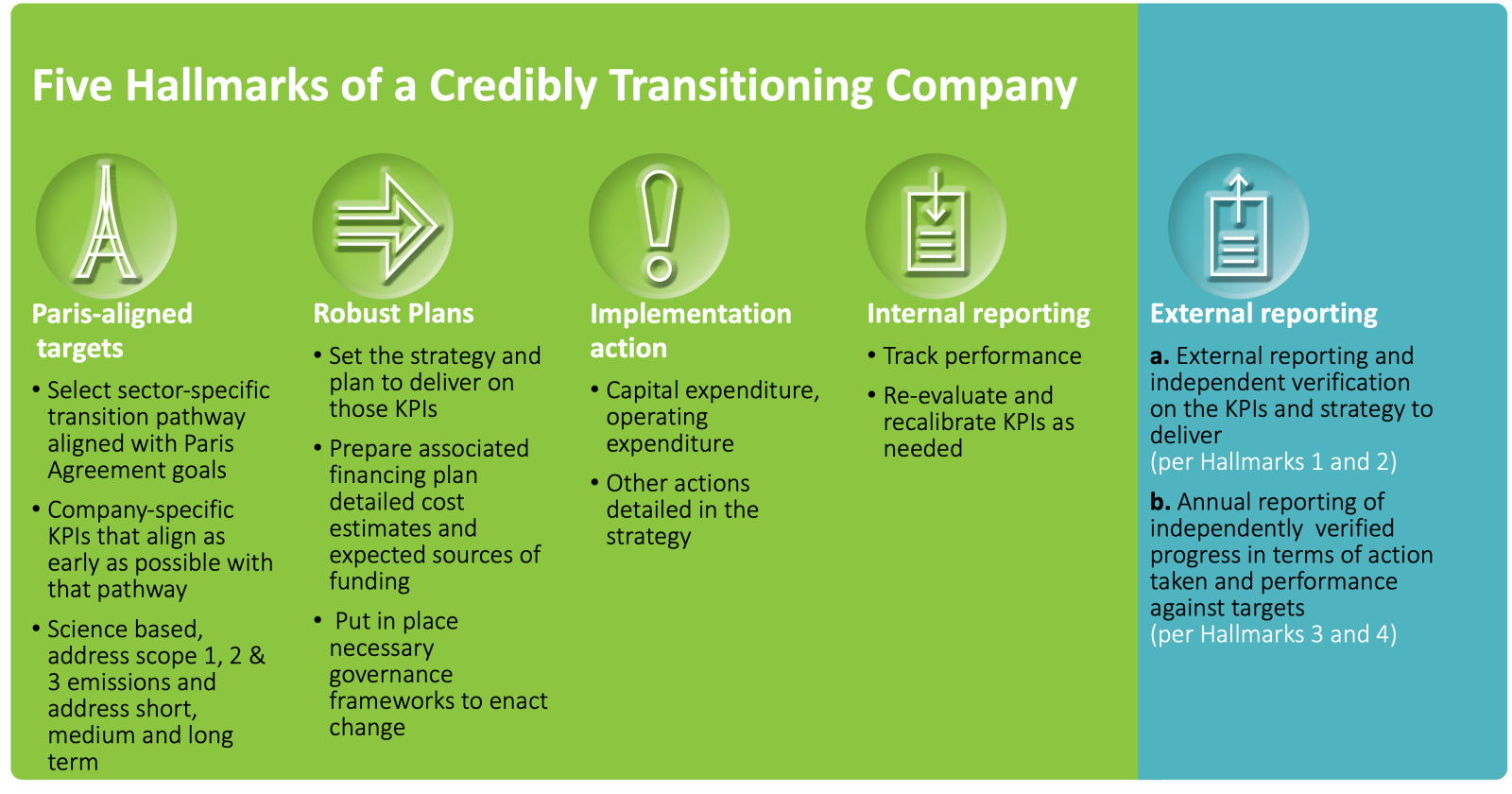

Frameworks to Assess Transition

finance Archives - Brazilian-American Chamber of Commerce

6kubsgri2019

News Sustainable Stock Exchanges