IRS Crypto 1099 Form: 1099-K vs. 1099-B vs. 1099-MISC

Have you received a 1099-K, 1099-B or 1099-MISC form about your crypto? Here’s what you need to know about 1099 forms and what it means for your crypto taxes.

:max_bytes(150000):strip_icc()/form-1099-c-understanding-your-1099-c-form-4782275_final-9a33850e37ad4d54839284865d5b507b.png)

Form 1099-C: Cancellation of Debt: Definition and How to File

The Simplest DIY Tax Guide For 1099-MISC Filers For The Tax Year 2022-23

Understanding Changes in Form 1099-K Reporting for 2023 Tax Season

:max_bytes(150000):strip_icc()/Screenshot2023-11-16at7.16.51PM-d34254919c9046c5ba06031f3f5fb7fb.png)

Form 1099-R: What It's Used for and Who Should File It

1099-MISC vs. 1099-K: What's the Difference?

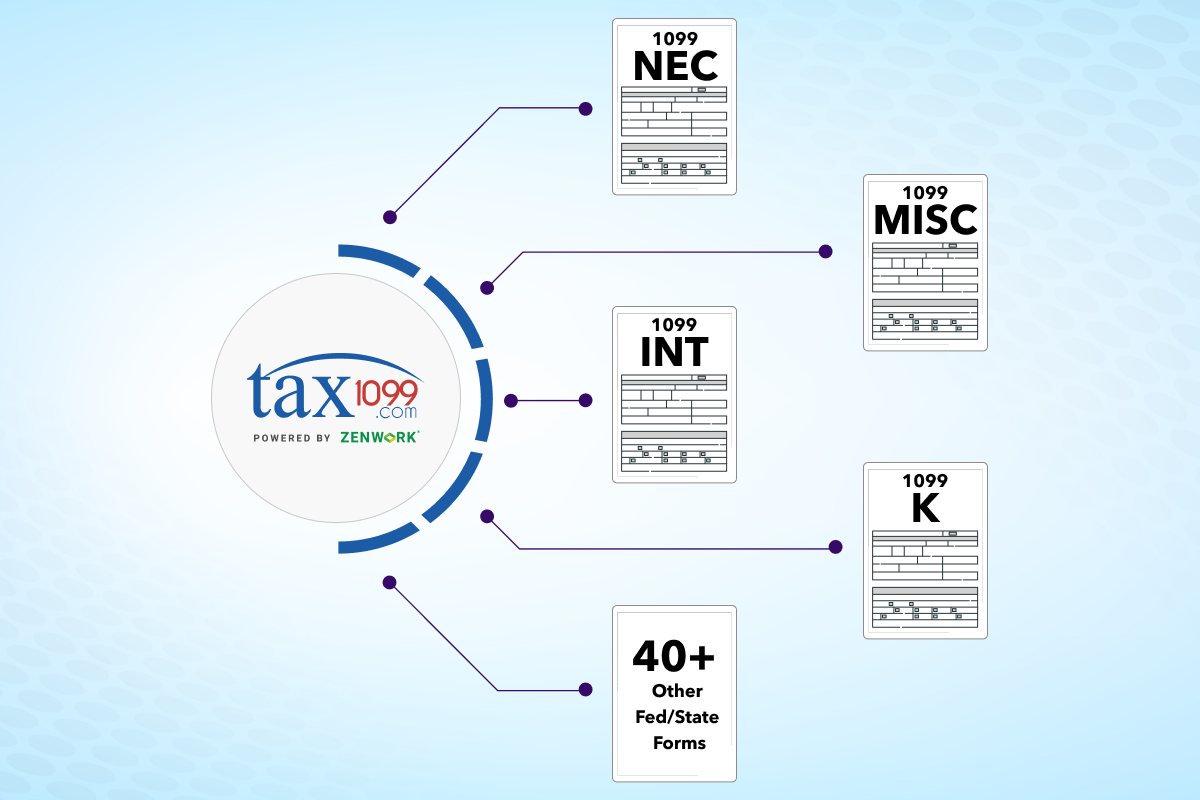

Tax1099 supports 1099-K, 1099-INT, 1099-NEC, 1099-MISC, and 40+ Other Fed/State Forms

If You Don't Get Form 1099, Is It Taxable, Will IRS Know? (Hint: 'If A Tree Falls In The Forest')

Tax forms, explained: A guide to U.S. tax forms and crypto reports

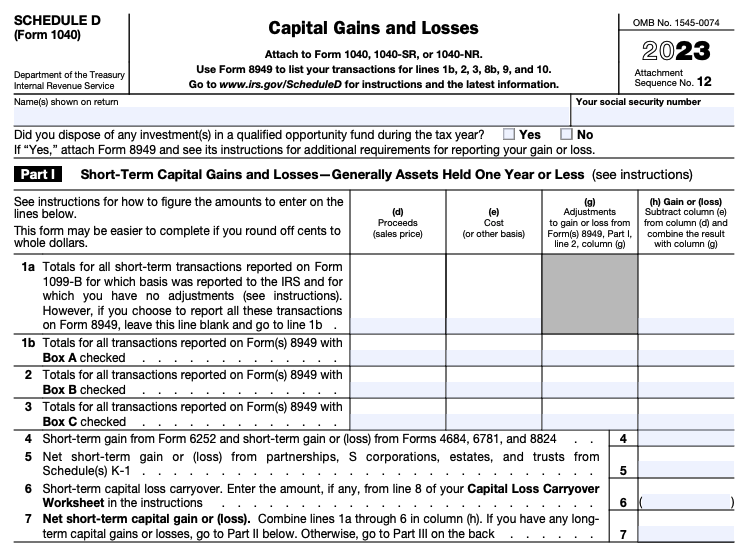

How to Report Crypto on Taxes in 2024

Crypto Tax FAQs: What If I Don't Get a 1099 from Coinbase or Other Exchanges?

1099 tax form, 1099

Will Binance.US send a 1099? - Quora

From 1099 Crypto: Easy Instructions + Info [2024]